Iran's Rial: Unpacking The Currency Of The Islamic Republic

The Islamic Republic of Iran, a country rich in history and culture, situated in West Asia, boasts a unique economic landscape heavily influenced by its energy resources and complex geopolitical standing. At the heart of this economy lies its national currency, the Iranian Rial. Understanding the nuances of the Iranian Rial (IRR) is crucial for anyone seeking to comprehend Iran's financial system, its challenges, and its future trajectory.

Despite its historical significance, dating back centuries, the Iranian Rial faces considerable challenges, including the impact of international economic sanctions, periods of political instability, and ongoing discussions about its replacement with a new official currency, the Toman. This article delves deep into the intricacies of the Islamic Republic of Iran's currency, exploring its history, its governing bodies, its current state, and the potential transformations on its horizon.

Table of Contents

- The Iranian Rial: An Introduction

- Historical Roots and Evolution of Iran's Currency

- The Central Bank's Pivotal Role in Currency Issuance

- Denominations: Banknotes and Coins in Circulation

- The Rial's Standing in the Global Foreign Exchange Market

- The Toman Transition: A New Era for Iranian Currency?

- Economic Challenges and Their Impact on the Rial

- Navigating the Iranian Currency Landscape

The Iranian Rial: An Introduction

The Iranian Rial (IRR) stands as the official legal currency of the Islamic Republic of Iran. Its presence is ubiquitous across the nation, from bustling bazaars to international transactions facilitated by the state. The unit of Iranian currency is, unequivocally, the Rial. This monetary unit, symbolized by ﷼ and carrying the currency code IRR, plays a central role in the daily lives of Iranians and the broader economic operations of the country. While the Rial is the official currency, it's worth noting that due to its extremely low value, it is not commonly traded in the foreign exchange market in the same way major global currencies are. Its primary function remains within the domestic economy of Iran, which is significantly shaped by its vast oil industry and the pervasive influence of international sanctions.

The journey of the Iranian Rial, introduced officially in 1798 and then again in its modern form in 1932, reflects the complex history of the nation itself. It has witnessed periods of economic growth, geopolitical shifts, and significant challenges that have profoundly impacted its value and utility. As we delve deeper, we will explore the mechanisms governing its issuance, its physical forms, and the economic forces that have shaped its current standing.

Historical Roots and Evolution of Iran's Currency

The history of Iran's currency is as rich and intricate as the nation's ancient heritage, officially known as the Islamic Republic of Iran, and historically referred to as Persia. The Iranian Rial (IRR) as we know it today has a long lineage, with its introduction dating back to 1798. However, the modern iteration of the Rial, which serves as the official monetary unit of Iran, was formally introduced in 1932. This reintroduction marked a significant step in standardizing Iran's monetary system, moving away from older forms of currency and establishing a more unified economic framework.

Over the centuries, Iran has seen various forms of currency, reflecting different dynasties, economic policies, and trade relationships. The decision to adopt the Rial in 1932 was part of a broader modernization effort within the country. Since then, the Rial has been the bedrock of Iran's financial system, facilitating commerce, investment, and daily transactions. Despite its deep historical roots and continuous presence, the Rial has consistently faced evolving challenges, from internal economic pressures to external geopolitical factors, which have collectively shaped its journey through the 20th and 21st centuries. Understanding this historical context is vital to appreciating the current dynamics surrounding the Islamic Republic of Iran's currency.

The Central Bank's Pivotal Role in Currency Issuance

In any sovereign nation, the authority to issue currency is a cornerstone of economic control and stability. In the Islamic Republic of Iran, this immense responsibility rests exclusively with one institution: Bank Markazi Iran, more commonly known as the Central Bank of the Islamic Republic of Iran (CBI). The CBI is not merely a regulatory body; it is the sole authority endowed with the right to issue notes and coins, a power that is explicitly defined and protected by national law. This centralized control ensures uniformity and integrity within the nation's monetary system, making the CBI an indispensable pillar of Iran's financial architecture.

The Central Bank of Iran's mandate extends beyond just printing money. It involves managing the country's monetary policy, maintaining price stability, overseeing the banking system, and managing foreign exchange reserves. Its decisions directly influence the value and availability of the Iranian Rial, thereby impacting every facet of the Iranian economy. The exclusive authority vested in the CBI underscores the government's commitment to maintaining a controlled and centralized approach to its currency management.

Legal Framework: The Monetary and Banking Act of Iran

The legal foundation for the Central Bank of the Islamic Republic of Iran's exclusive currency issuance rights is firmly established in the Monetary and Banking Act of Iran (MBAI). According to this critical piece of legislation, the government is the sole authority having the right of issuing notes and coins. This right, however, is not directly exercised by the government but is vested exclusively in Bank Markazi Iran, subject to the provisions outlined within the act itself. This legal framework provides a clear mandate and sets the boundaries within which the CBI operates, ensuring that the issuance of the Islamic Republic of Iran's currency is conducted in a structured, legal, and accountable manner.

The MBAI serves as the blueprint for Iran's monetary and banking system, delineating the powers and responsibilities of key financial institutions. By centralizing currency issuance under the CBI, the act aims to prevent unauthorized printing, counterfeiting, and other activities that could undermine the integrity and stability of the Iranian Rial. This robust legal backing is crucial for maintaining public trust in the national currency and for the effective implementation of monetary policy in the Islamic Republic of Iran.

Denominations: Banknotes and Coins in Circulation

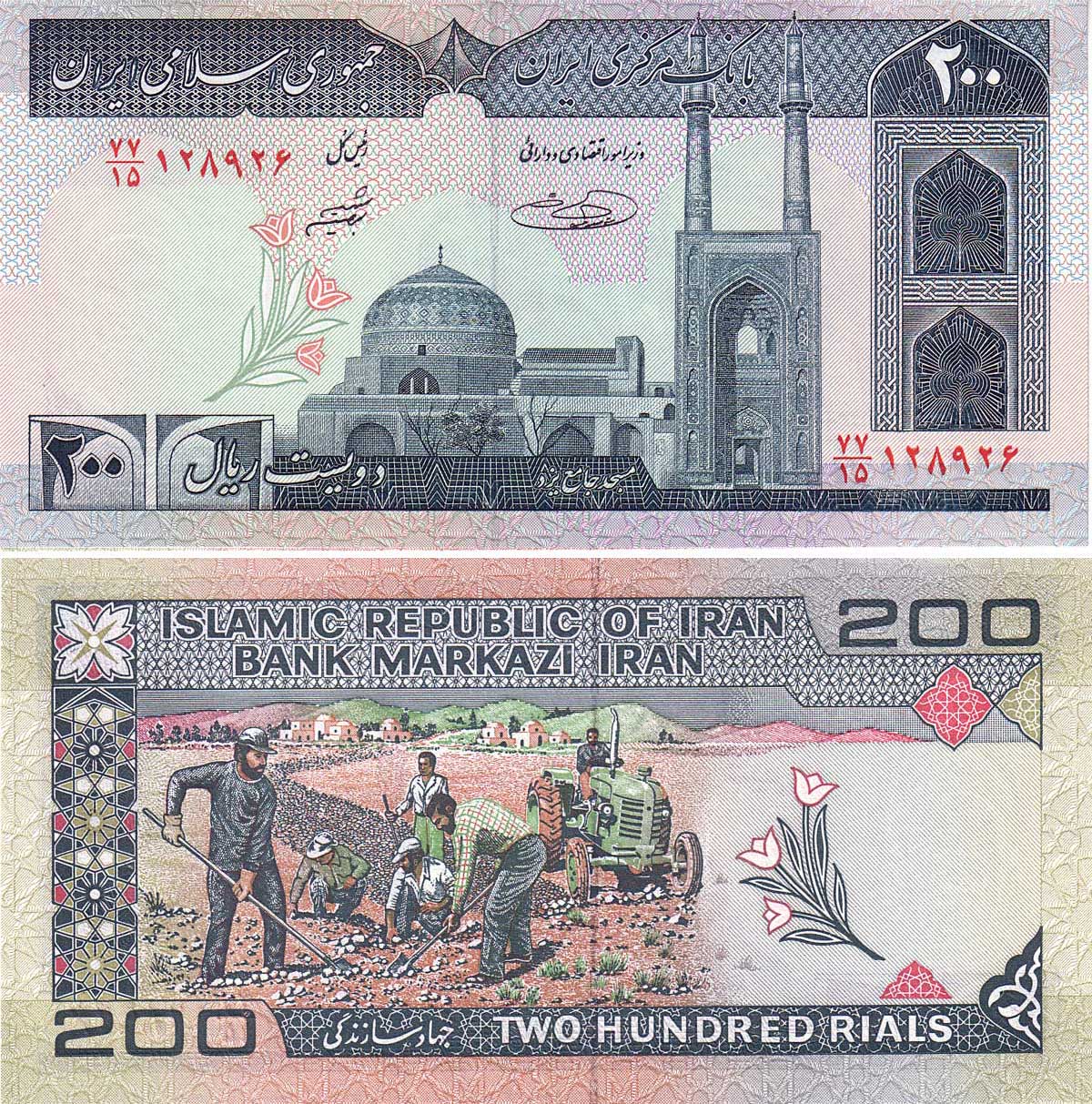

The Iranian Rial, as the official currency of the Islamic Republic of Iran, is circulated in both banknotes and coins, designed to facilitate a wide range of transactions from everyday purchases to larger financial dealings. These physical forms of currency are a tangible representation of Iran's economic activity and are intricately designed with cultural and national symbols.

- Coins: Coins are issued in various denominations, primarily catering to smaller transactions. According to the Central Bank of the Islamic Republic of Iran, these typically range from 5 to 500 rials. While these smaller values are less frequently encountered in daily transactions due to the Rial's low purchasing power, they remain an official part of the currency system.

- Banknotes: Banknotes represent the larger denominations and are the most commonly used form of the Iranian Rial for daily commerce. These are denominated in values ranging from 100 rials up to 20,000 rials. Larger denominations, such as the 20,000 rial note, are often informally referred to in "Toman" terms (2,000 Toman), reflecting the common practice of dropping a zero for ease of calculation, a practice that highlights the ongoing discussion about the Toman's official reintroduction. These banknotes feature prominent figures and landmarks, reflecting the nation's rich heritage and modern identity. The design and security features of these notes are meticulously managed by the Central Bank of the Islamic Republic of Iran to prevent counterfeiting and ensure public confidence in the Islamic Republic of Iran's currency.

The Rial's Standing in the Global Foreign Exchange Market

The Iranian Rial (IRR), despite being the official currency of the Islamic Republic of Iran, holds a rather unique and limited position within the global foreign exchange market. Unlike major currencies such as the US Dollar, Euro, or Japanese Yen, the Iranian Rial is not commonly traded on international forex platforms. This limited tradability is primarily due to its extremely low value and the complex web of economic sanctions and political factors that have isolated Iran from much of the global financial system. Consequently, liquidity for the IRR in the international market is minimal, making it an unattractive asset for speculative trading or widespread international transactions.

The challenges faced by the Rial in the foreign exchange market reflect broader economic pressures on Iran. The government, through the Central Bank of the Islamic Republic of Iran, has at times attempted to manage foreign exchange rates through various mechanisms, including the establishment of foreign exchange centers to provide importers with foreign currency at preferential rates. However, the gap between official rates and open market rates often persists, indicating the underlying pressures on the Islamic Republic of Iran's currency.

Popular Exchange Rates and Currency Codes

While the Iranian Rial may not be a global forex powerhouse, its exchange rate against major currencies, particularly the United States Dollar (USD), is of paramount importance domestically and for those engaging in trade or travel with Iran. Our currency rankings consistently show that the most popular Iranian Rial exchange rate is the IRR to USD rate. This pairing is crucial because the US Dollar often serves as a benchmark for the value of the Rial, especially given Iran's reliance on oil exports, which are typically priced in dollars.

The currency code for Rials is IRR, and its currency symbol is ﷼. These identifiers are universally recognized in financial systems, even if the currency itself is not widely traded. For those needing to convert currencies, various online tools offer Iranian Rial rates and currency converters, though it's always advisable to consult real-time market data, especially given the volatility that can affect the Islamic Republic of Iran's currency. The US Dollar data, for instance, remains an active status in CEIC and is reported by the Central Bank of the Islamic Republic of Iran, highlighting the continued relevance of this exchange rate despite the challenges.

The Toman Transition: A New Era for Iranian Currency?

One of the most significant and long-discussed developments concerning the Islamic Republic of Iran's currency is the planned redenomination and replacement of the Rial with a new official currency, the Toman. This move, which has been under consideration for years, aims to simplify transactions and calculations by effectively removing four zeros from the Rial's value. The Toman has long been the informal unit of Iranian currency, with people commonly referring to amounts in Tomans (e.g., 20,000 Rials is often called 2,000 Tomans). The official reintroduction of the Toman between 2020 and 2022 was intended to formalize this common practice and streamline the nation's monetary system.

The transition to the Toman is more than just a cosmetic change; it reflects an attempt to address the practical difficulties arising from the Rial's extremely low value, which necessitates handling large numerical figures for even modest transactions. While the process has been gradual and faced its own set of complexities, the intention behind it is clear: to modernize the currency system and potentially restore some psychological confidence in the national monetary unit. This redenomination is a strategic move by the Central Bank of the Islamic Republic of Iran to improve the efficiency of financial operations and make the currency more manageable for both citizens and businesses.

Digital Rial: The Future of Iran's National Currency?

Beyond the Toman redenomination, the Islamic Republic of Iran is also exploring the frontier of digital currencies. The concept of a "Digital Rial" or Iran's national currency in digital form represents a significant leap into modern financial technology. According to announcements from the Central Bank of the Islamic Republic of Iran, the release of this digital currency is based on the "modern rial" and the current series of the Iranian Rial. This initiative positions Iran among a growing number of nations worldwide that are investigating or implementing Central Bank Digital Currencies (CBDCs).

A digital Rial would essentially be a digital representation of the fiat currency, issued and backed by the Central Bank, offering a secure and potentially more efficient alternative to physical cash. This move could have profound implications for financial transactions, payment systems, and monetary policy within Iran. It could facilitate faster and cheaper domestic payments, enhance financial inclusion, and provide the Central Bank with greater oversight over money flows. As the world moves towards a more digitized economy, the exploration of a Digital Rial by the Central Bank of the Islamic Republic of Iran signifies the nation's intent to adapt and innovate within the global financial landscape, potentially offering a new dimension to the Islamic Republic of Iran's currency in the years to come.

Economic Challenges and Their Impact on the Rial

The Iranian Rial (IRR) has endured a tumultuous journey, significantly impacted by a confluence of severe economic challenges. The official currency of the Islamic Republic of Iran has been under immense pressure for decades, leading to a dramatic depreciation in its value. This has had profound implications for the daily lives of Iranians and the overall stability of the national economy. The struggles faced by the Rial are not isolated incidents but rather symptoms of deep-seated issues that have tested the resilience of Iran's financial system.

One of the most striking figures illustrating this challenge is the staggering fall in the value of Iran’s national currency, which has plummeted by about 99.99% over an extended period. This level of depreciation is almost unparalleled globally and highlights the severity of the economic pressures. Such a drastic loss of purchasing power erodes savings, makes imports prohibitively expensive, and fuels inflation, creating significant hardship for the populace. The government has attempted various measures to mitigate these effects, including the launch of a foreign exchange center in 2012, designed to provide importers of some basic goods with foreign exchange at a rate approximately 2% cheaper than the open market rate. However, these efforts often struggle against the tide of larger economic forces.

Sanctions, Instability, and Value Depreciation

The primary drivers behind the Iranian Rial's struggles are multifaceted, but economic sanctions and political instability stand out as the most impactful. The Islamic Republic of Iran has been subjected to extensive international sanctions, particularly from the United States, targeting its oil industry, banking sector, and other key economic pillars. These sanctions severely restrict Iran's ability to engage in international trade, access global financial markets, and repatriate its oil revenues. This isolation limits foreign investment, stifles economic growth, and reduces the supply of foreign currency within the country, directly contributing to the depreciation of the Iranian Rial.

Furthermore, periods of political instability, both internal and regional, exacerbate economic uncertainty. Such instability deters investors, encourages capital flight, and creates an environment where long-term economic planning becomes incredibly difficult. The combination of these factors leads to a cycle of inflation, a weakened currency, and a decline in living standards. The discussions of the Rial's replacement with the Toman, while a practical measure, also underscore the extent of the depreciation and the need for a fundamental revaluation of the Islamic Republic of Iran's currency to restore confidence and stability in its monetary system.

Navigating the Iranian Currency Landscape

Understanding the Islamic Republic of Iran's currency, the Rial, is an exercise in appreciating a complex interplay of history, economics, and geopolitics. From its official introduction in 1798 and its modern iteration in 1932, to its current challenges stemming from economic sanctions and political instability, the Rial has been a central character in Iran's narrative. The Central Bank of the Islamic Republic of Iran, as the sole authority for currency issuance under the Monetary and Banking Act of Iran, plays a critical role in managing this intricate system, from circulating banknotes and coins in various denominations to exploring the future of a Digital Rial.

While the Rial's low value and limited international trade present unique challenges, the ongoing transition to the Toman and the potential for a digital currency signify a dynamic effort to modernize and stabilize Iran's monetary system. For anyone engaging with Iran, whether for business, travel, or academic interest, grasping the nuances of the Iranian Rial is essential for navigating its unique economic landscape. The story of the Islamic Republic of Iran's currency is far from over; it continues to evolve, reflecting the resilience and adaptability of a nation facing significant internal and external pressures.

We hope this comprehensive overview has provided valuable insights into the Iranian Rial. What are your thoughts on the future of Iran's currency? Do you have any experiences or observations to share regarding its use? Feel free to leave your comments below and join the discussion. If you found this article informative, please consider sharing it with others who might be interested in the economic dynamics of the Islamic Republic of Iran. You might also find our other articles on global economic trends equally insightful.

Iran Currency Coins Set 20 Riyal 50 Riyal 10 Riyal Stock Image - Image

clay@panix.com

clay@panix.com